The Future of Digital Real Estate: Exploring Metaverse Investments

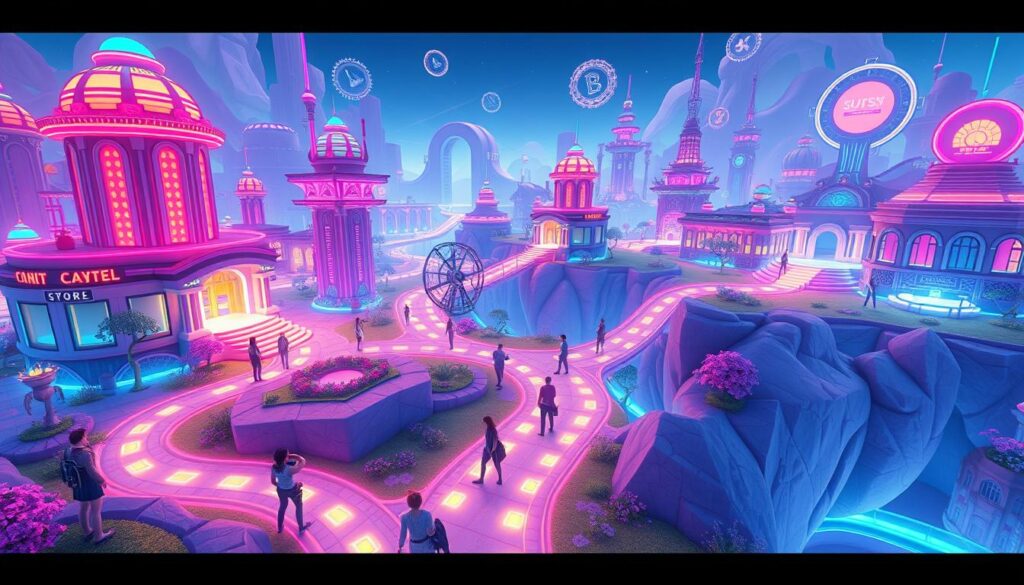

I’m excited to dive into the world of digital real estate. Metaverse investments offer vast opportunities. The future of digital real estate is changing fast. It’s key to know where we stand in this new market.

Blockchain and cryptocurrency are making the metaverse more appealing. Investors see it as a chance to grow their portfolios. Virtual real estate is opening up new ways to invest.

Digital real estate is changing how we view property investment. I’m eager to learn about metaverse investments. The possibilities, from owning virtual land to developing digital properties, are endless.

I aim to offer expert advice on digital real estate’s future. Whether you’re new or experienced, I’m here to help. I want to guide you through the world of metaverse investments.

Key Takeaways

- The future of digital real estate is closely tied to the growth of metaverse investments

- Digital real estate offers a new frontier for property investment and development

- Blockchain technology and cryptocurrency are driving the growth of the metaverse

- Understanding virtual real estate is crucial for making informed investment decisions

- The metaverse presents a unique opportunity for investors to diversify their portfolios

- Digital real estate investments require a deep understanding of the underlying technology and market trends

Understanding Digital Real Estate in the Metaverse

Digital real estate is a fast-growing market. It involves virtual real estate, cryptocurrency investments, and blockchain technology. It’s about owning and managing virtual properties, from simple land to complex worlds.

Blockchain technology is key to this growth. It makes transactions in the metaverse secure and clear. It also leads to nft investments, unique digital assets that can be traded like stocks.

What Constitutes Virtual Property

Virtual property includes land, buildings, and digital assets. These can be used for fun, learning, or business. As the metaverse grows, so will the uses of virtual property.

How Digital Land Ownership Works

Digital land ownership uses blockchain technology and cryptocurrency investments. It ensures safe and clear transactions. It also proves and transfers ownership of virtual properties.

The Role of Blockchain Technology

Blockchain technology is vital in the metaverse. It supports secure transactions and helps digital real estate grow. As it evolves, we’ll see new uses, like nft investments and digital assets.

Why Digital Real Estate Is Revolutionizing Property Investment

Digital real estate is changing how we invest in property. It lets people easily buy digital assets like virtual land and buildings. This is thanks to metaverse investments.

Investing in digital real estate has many benefits. It’s more accessible, so anyone with internet can join. Also, it costs less to buy and sell, which is good for investors. Key benefits include:

- Lower barriers to entry

- Reduced transaction costs

- Potential for higher returns on investment

The metaverse investments market is growing fast. This means the value of digital assets will likely go up. It’s a great chance for investors to make money in the long run. With new technology, the future of digital real estate looks bright.

Understanding digital real estate helps investors make smart choices. As the market grows, keeping up with trends is key to making money.

| Investment Type | Potential Return | Risk Level |

|---|---|---|

| Digital Real Estate | High | Moderate |

| Traditional Real Estate | Moderate | High |

The Future of Digital Real Estate: Metaverse Investments Explained

Exploring metaverse investments means looking at current trends and future growth. The digital real estate market is booming. Many investors are turning to cryptocurrencies to diversify their portfolios.

Current Market Trends

The demand for digital real estate is skyrocketing. This is thanks to the rise in metaverse investments. Big names like Decentraland and The Sandbox are at the forefront, creating virtual worlds and experiences.

Growth Projections

Experts predict a big jump in the value of digital real estate in the coming years. Blockchain technology will be key in making transactions safe and clear in the metaverse.

Major Players in the Space

Big players in digital real estate are pouring money into metaverse investments. They see huge potential for returns. As the market grows, we’ll likely see new players bring fresh ideas and drive growth.

Getting Started with Metaverse Property Investment

To start investing in the metaverse, you need to understand digital real estate. The metaverse is a virtual world where you can buy, sell, and create digital assets. Metaverse investments are becoming more popular, so it’s important to research before investing in virtual real estate.

Here are some steps to consider when getting started with metaverse property investment:

- Research the different metaverse platforms and their features

- Understand the concept of emerging technology and its impact on the digital real estate market

- Evaluate potential investment opportunities and their risks

As the metaverse grows, digital real estate is becoming more appealing to investors. With the right knowledge and strategy, you can make smart choices about your metaverse investments. This could lead to a significant return on your investment.

Keep up with the latest trends and developments in the metaverse and virtual real estate market. This will help you maximize your investment.

| Metaverse Platform | Features | Investment Opportunities |

|---|---|---|

| Decentraland | Virtual land, assets, and experiences | Buy, sell, and rent virtual real estate |

| The Sandbox | Virtual land, assets, and experiences | Buy, sell, and rent virtual real estate |

Popular Metaverse Platforms for Real Estate Investment

Metaverse investments are becoming more popular. It’s important to look at the top platforms for digital real estate. These platforms let investors buy, sell, and trade virtual properties. They use cryptocurrency for transactions.

Some top platforms for virtual real estate include:

- Decentraland: A blockchain-based platform that lets users create, experience, and monetize content and applications.

- The Sandbox: A decentralized, community-driven platform that enables users to create, sell, and own digital assets and experiences.

- Other emerging platforms: Such as Somnium Space and Cryptovoxels, which offer unique features and opportunities for digital real estate investment.

These platforms are helping the metaverse investments market grow. Many investors want to make money from virtual real estate. By knowing what these platforms offer, investors can make smart choices.

The metaverse is always changing, bringing new platforms and opportunities. Whether you’re new or experienced in metaverse investments, it’s key to keep up with the latest. This way, you can make the most of your investments.

| Platform | Features | Investment Opportunities |

|---|---|---|

| Decentraland | Blockchain-based, user-generated content | Buy, sell, and trade virtual land and assets |

| The Sandbox | Decentralized, community-driven, digital asset creation | Invest in digital assets, experiences, and applications |

| Other Emerging Platforms | Unique features, such as virtual reality experiences | Invest in digital real estate, assets, and experiences |

Understanding the Risks and Challenges

Exploring digital real estate is exciting, but it’s crucial to know the risks. Investing in this area can be both risky and rewarding, especially with cryptocurrency. It’s a high-stakes game.

There are several risks to watch out for. These include market ups and downs, regulatory uncertainty, and security breaches. Also, the value of digital real estate can change fast. It’s key to keep up with market shifts.

Blockchain technology can help with some of these issues. It makes transactions safer and more transparent.

Here are some key points to think about when looking at digital real estate investments:

- Market trends and growth projections

- The role of blockchain technology in securing transactions

- The potential impact of regulatory changes on cryptocurrency investments

By understanding these points and keeping up with metaverse news, investors can make better choices. This way, they can navigate digital real estate with confidence.

Investing in digital real estate needs a deep understanding of the risks. Knowing these risks and making informed decisions can help investors succeed in the metaverse.

How to Evaluate Digital Real Estate Opportunities

Exploring digital real estate requires understanding how to spot good opportunities. With metaverse investments on the rise, investors seek to profit from virtual real estate. It’s key to evaluate digital properties and find areas with high growth potential.

When looking at digital real estate chances, keep these points in mind:

- Location assessment in virtual worlds: Knowing the layout and who lives there is crucial for property value.

- Market value indicators: Look at trends, supply and demand, and pricing to guide your metaverse investments.

- Development potential analysis: Check if virtual areas can grow and appreciate in value over time.

By thinking about these points and keeping up with emerging technology, investors can confidently explore digital real estate. They can make smart choices about their metaverse investments.

Monetization Strategies for Virtual Properties

Exploring digital real estate is exciting. There are many ways to make money from virtual properties. One method is renting or leasing them out. This can bring in a steady income.

Hosting virtual events is another strategy. This can include concerts, conferences, and more. It attracts a lot of people and can make money. Digital ads also bring in income as brands seek to reach people in the metaverse.

- Rental and leasing options

- Virtual events and experiences

- Digital advertising revenue

- Cryptocurrency investments

Knowing these strategies helps investors make smart choices. They can take advantage of the growing demand for digital real estate.

| Monetization Strategy | Description |

|---|---|

| Rental and Leasing | Generate revenue by renting or leasing virtual properties |

| Virtual Events | Host interactive experiences and events to drive revenue |

| Digital Advertising | Monetize virtual properties through targeted advertising |

| Cryptocurrency Investments | Invest in cryptocurrencies to diversify portfolio and tap into metaverse growth |

Conclusion: Embracing the Virtual Real Estate Revolution

The world of digital real estate and metaverse investments is exciting. It shows that the future of owning property is moving online. Virtual real estate and emerging technology are creating new chances for investors.

Investors can learn about digital real estate and metaverse platforms. This knowledge helps them make smart choices. As the metaverse grows, so does the value of virtual real estate.

I suggest looking into digital real estate. See how metaverse investments can be part of your plan. The virtual real estate revolution is here. Those who jump in now could see big gains in this new field.

FAQ

What is digital real estate in the metaverse?

Digital real estate in the metaverse is virtual property in online worlds. It includes virtual land, buildings, and digital assets. These can be owned, developed, and made money from.

How does digital land ownership work in the metaverse?

Digital land ownership uses blockchain technology. This makes transactions secure and clear. People buy virtual land as non-fungible tokens (NFTs), showing they own it.

What are the benefits of investing in digital real estate?

Investing in digital real estate has many benefits. It’s more accessible and has lower costs. It also offers the chance for higher returns. The metaverse lets you use virtual property in new ways, like hosting events.

What are some popular metaverse platforms for real estate investment?

Popular platforms for real estate investment include Decentraland and The Sandbox. These platforms let users buy, sell, and develop virtual properties.

What are the risks and challenges associated with investing in digital real estate?

Investing in digital real estate has risks like market volatility and regulatory uncertainty. There’s also the chance of tech problems. It’s key to know these risks before investing.

How can I evaluate digital real estate opportunities?

To evaluate digital real estate, look at location, market value, and development potential. Also, check the technology and platform’s security and reliability.

What are some monetization strategies for virtual properties?

Monetizing virtual properties can be done through rentals, leasing, hosting events, and digital ads. Investors can find other creative ways to make money from their digital assets.